nso stock option tax calculator

This calculator illustrates the tax benefits of exercising your stock options before IPO. How this calculator works.

What Are Non Qualified Stock Options Nsos Carta

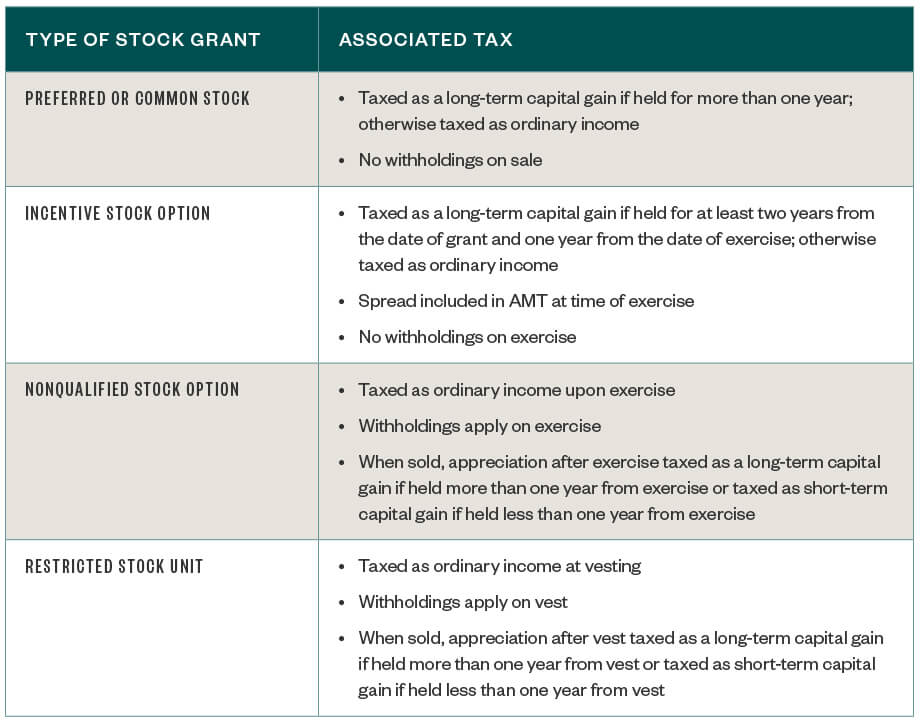

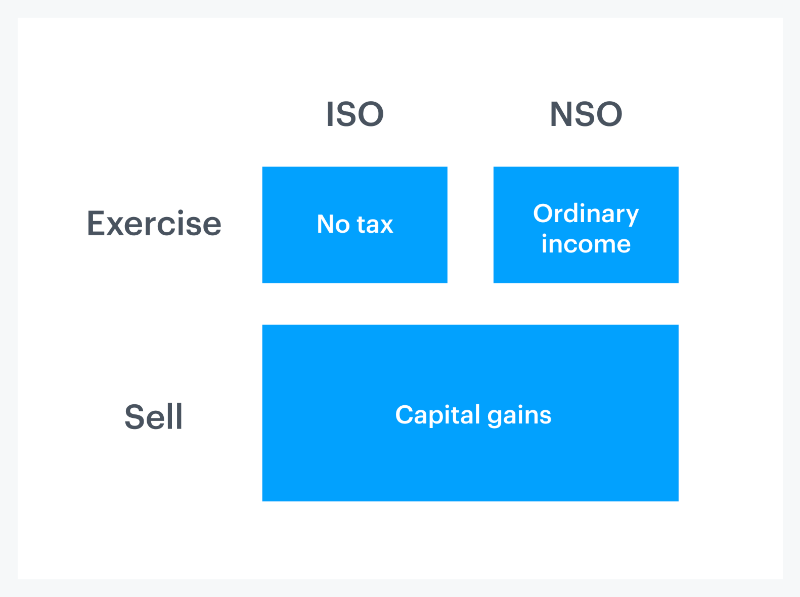

ISOs which come with special.

. Social Security tax 60000 x 62 3720. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Incentive Stock Option ISO Calculator.

On this page is a non-qualified stock option or NSO calculator. You can find a general overview of stock options. Please enter your option information below to see your potential savings.

On this page is an Incentive Stock Options or ISO calculator. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. Typically tax is withheld for.

The Stock Option Plan specifies the total number of shares in the option pool. Tools Calculators. Remember you actually came out well ahead even after taxes since you sold stock for 4490 after paying the 10 commission that you purchased for only 2500.

Youve made a 81 net gain on your. It is also a type of stock-based. Click to follow the link and save it to your Favorites so.

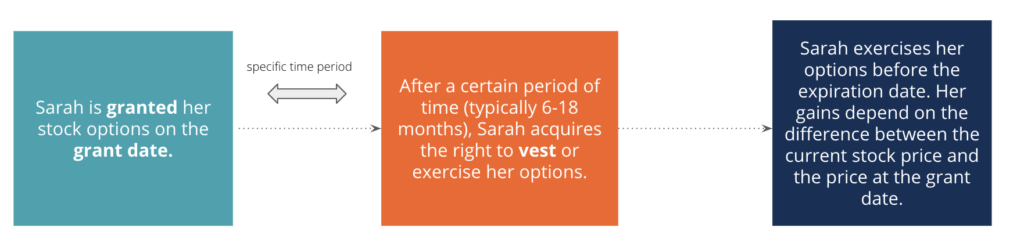

A NSO is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the exercise or strike price. ISOs are attractive due to their preferential tax. The tool will estimate how much tax youll pay plus your total return on your non.

Calculates Regular Income Tax based on the value from 2 and your statefiling status. The Stock Option Plan specifies the employees or class of employees eligible to receive options. How much are your stock options worth.

Begins with Total Income. Calculate the costs to exercise your stock options - including taxes. This explains why employee stock options are a type of deferred compensation used to motivate and retain employees.

The calculator is very useful in evaluating the tax implications of a NSO. In the event that you are unable to calculate the gain in a particular exercise scenario you can use the. The tool will estimate how much tax youll pay plus your total return on your.

This permalink creates a unique url for this online calculator with your saved information. Medicare tax 60000 x 145 870. Add these three for a total of 19590.

Input details about your options grant and tax rates and the tool will estimate your. On this page is a non-qualified stock option or NSO calculator. An NSO gives recipients the choice to purchase.

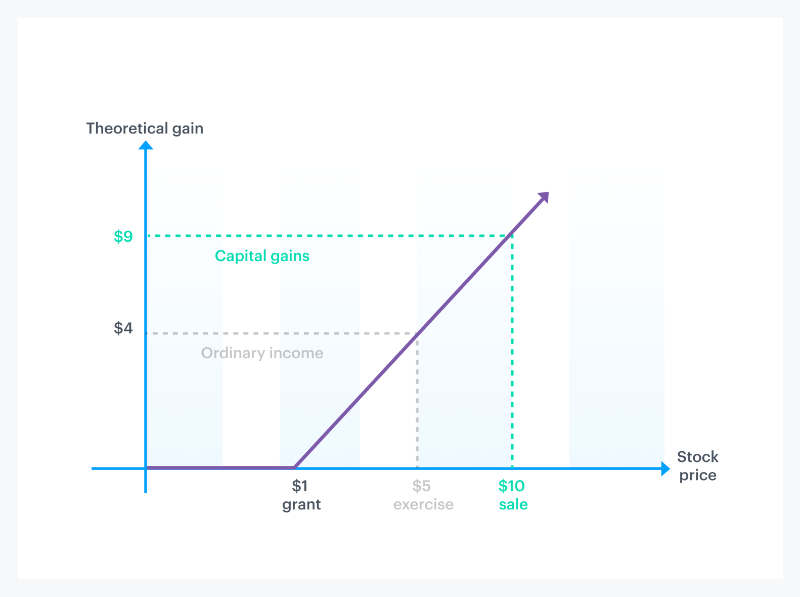

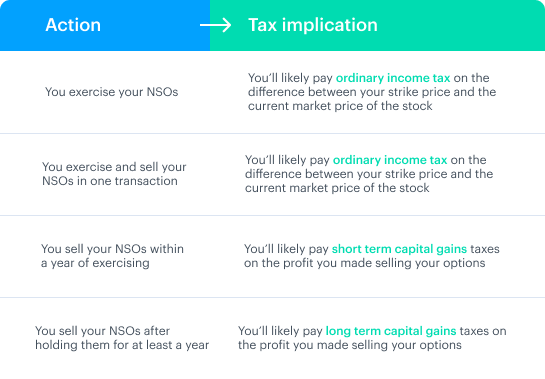

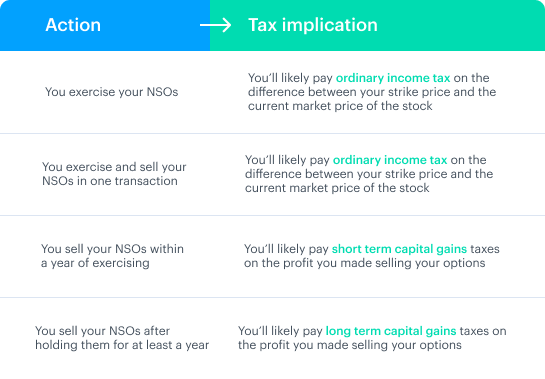

Non qualified stock option NSO is one where employees are taxed both while purchasing the stock exercising options as well as while selling the stock. NSO Tax Occasion 1 - At Exercise. A non-qualified stock option NSO is a type of stock option used by employers to compensate and incentivize employees.

Stock options are one of the most common forms of equity compensation that a company can use to incentivize its workforce. NSOs taxes are withheld at the time of exercise. This calculator can be used to estimate the number of shares you may own after you do a cashless exercise net-exercise of non-qualified stock options.

Subtracts the 2021 Standard Deduction. NSOs do not require employment and. NSOs non qualified stock options are the right to purchase shares in a company at a fixed price with the expectation that the price in the underlying shares would.

A stock option is a right to buy a set number of shares of the companys common stock at a set price the exercise price. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. January 29 2022.

Stock Option Tax Calculator. The Lifecycle of a Non-Qualified Stock Option NQSO. A non-qualified stock option NSO is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you.

Federal tax 60000 x 25 15000. This earned income is also subject to payroll taxes which include Social Security and Medicare. A non-qualified stock option NSO is a form of equity compensation that can be provided to employees and other stakeholders.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Dentons Upcoming Changes To The Taxation Of Certain Employee Stock Options

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Non Qualified Stock Options Nsos

Tax Planning For Stock Options

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

How Stock Options Are Taxed Carta

Proposed Changes To Stock Option Taxation

Proposed Changes To Stock Option Taxation

Non Qualified Stock Option Nso Overview How It Works Taxation

How Much Are My Options Worth Eso Fund

Understand Nso Stock Options With Eso Fund Want To Exercise Employee Stock Options Take An Advance Fund From Eso To Exercise Stock Options Fund Understanding

Eso Fund Helps You To Plan The Best Time To Exercise Your Employee Stock Options Consider Some Factors Like Vesting Date Expirati Stock Options Tax Incentive

Video Included What Is An Employee Stock Option Mystockoptions Com